December 16, 2022

Housing Affordability Conditions Decrease in October 2022 as Mortgage Rates Touch 7%

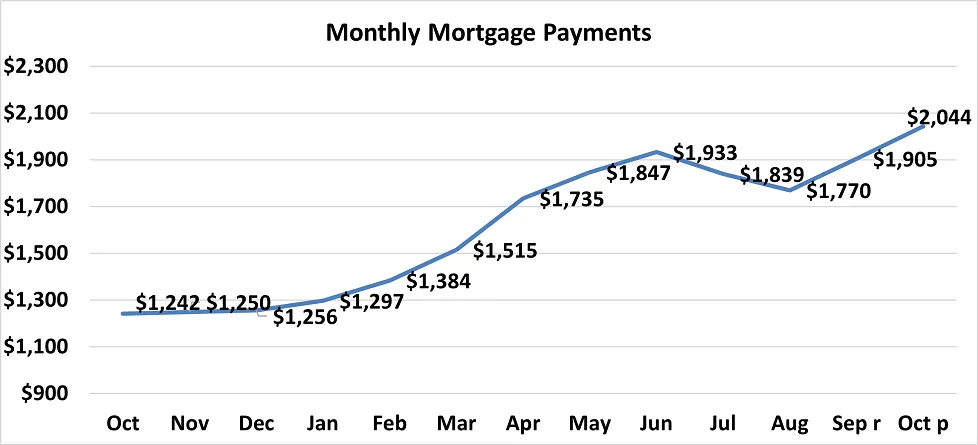

At the national level, housing affordability continued to fall in October compared to the previous month, according to NAR’s Housing Affordability Index. Compared to the prior month, the monthly mortgage payment increased by 7.3% while the median family income increased by 0.9%, making home buying less affordable in October. The monthly mortgage payment increased by $139 from last month.

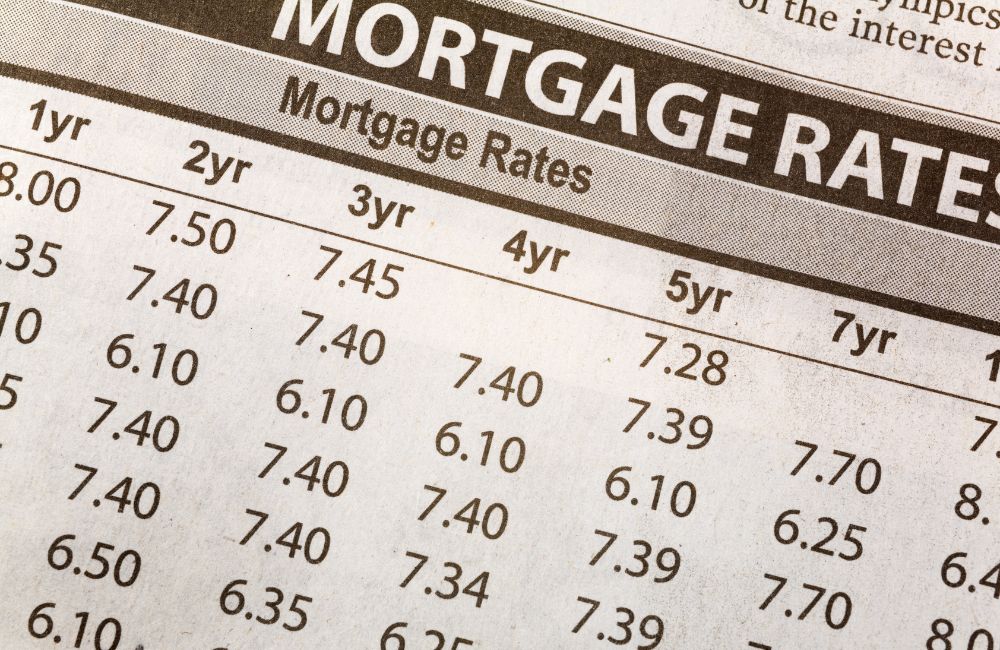

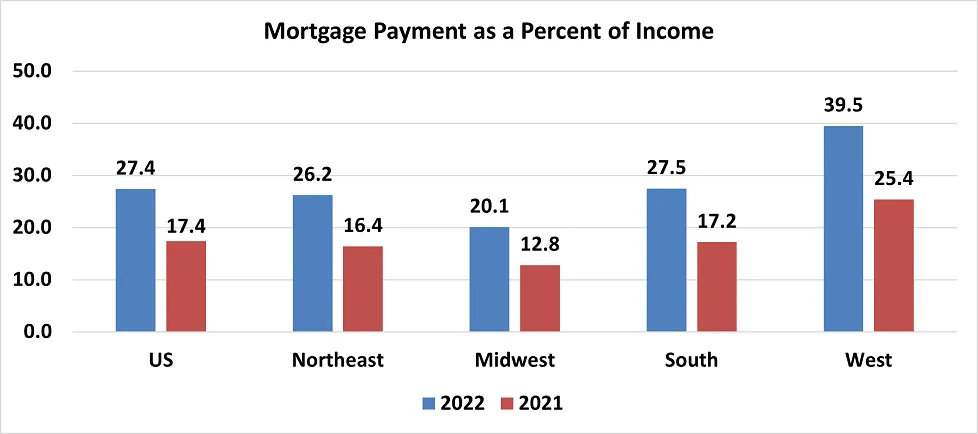

Compared to one year ago, affordability fell in October as the monthly mortgage payment climbed 64.6% and median family income rose by 4.6%. The effective 30-year fixed mortgage rate1 was 6.98% this October compared to 3.12% one year ago, and the median existing-home sales price rose 6.2% from one year ago. Mortgage rates this October were the highest since August 2001, when the rate was 7.06%. For comparison, the median home price was $160,700, and the monthly payment was $860, with the payment at a percentage of income at 20.1%The median family income was $51,456, and the qualifying income was $41,280.

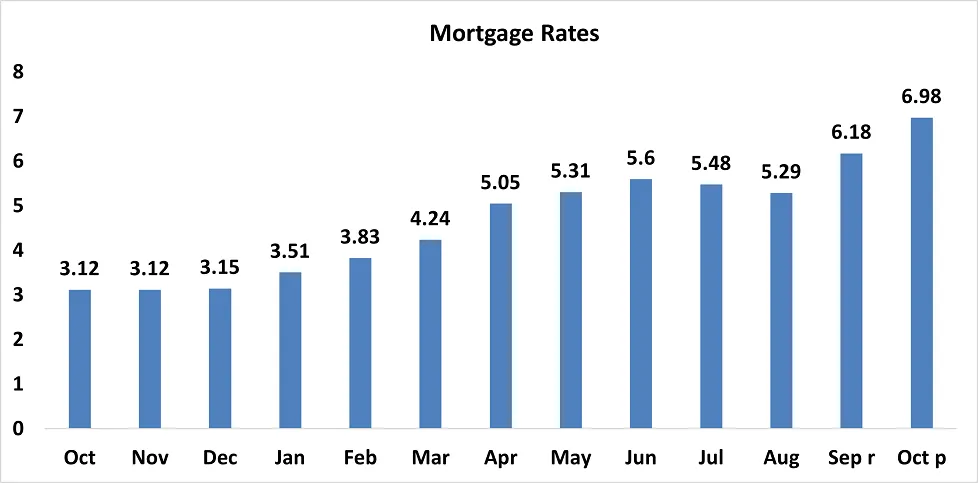

In October, potential home buyers need to make $8,605 more than the median family income ($89,507) to qualify for a home.

As of October 2022, the national index was below 100, which means that the typical family can no longer afford to buy the median-priced home. An index below 100 means that a family with a median income had less than the income required to afford a median-priced home. The income required to afford a mortgage, or the qualifying income, is the income needed so that mortgage payments on a 30-year fixed mortgage loan with a 20% down payment account for 25% of family income. 1The most affordable region was the Midwest, with an index value of 124.4 (median family income of $88,008 with a qualifying income of $70,752). The least affordable region remained the West, where the index was 63.4 (median family income of $97,523 and the qualifying income of $153,936). The Northeast was the second most affordable region with an index of 95.5 (median family income of $101,531 and qualifying income of $106,368). The South was the second most unaffordable region with an index of 91.0 (median family income of $82,043 with a qualifying income of $90,192).

A mortgage is affordable if the mortgage payment (principal and interest) amounts to 25% or less of the family’s income.1

Last week, the Mortgage Bankers Association released data showing that Mortgage applications decreased by 1.9 percent from one week earlier. Mortgage rates are leaning toward 7%, and mortgage payments have continued to climb. Home prices have fallen. However, the other factors in qualifying for a home have become more challenging to overcome for potential home buyers.

The Housing Affordability Index calculation assumes a 20 percent down payment and a 25 percent qualifying ratio (principal and interest payment to income). See further details on the methodology and assumptions behind the calculation(link is external).

1 Housing costs are burdensome if they take up more than 30% of income. The 25% share of mortgage payment to income takes into account that homeowners have additional expenses such as mortgage insurance, home insurance, taxes, and expenses for property maintenance.

2 A Home Affordability Index (HAI) value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).

3 Total housing costs that include mortgage payment, property taxes, maintenance, insurance, utilities are not considered burdensome of they account for no more than 30% of income.

Article written and research by Michael Hyman is a Research Data Specialist for the National Association of REALTORS®.

Mortgage Rates as of December 15, 2022:

Nadia Evangelou, Nadia Evangelou is Senior Economist and Director of Forecasting for the National Association of REALTORS®, states that “mortgage rates dropped even further this week as two main factors affecting today’s mortgage market became more favorable. Inflation continued to ease while the Federal Reserve switched to a smaller interest rate hike. As a result, according to Freddie Mac, the 30-year fixed mortgage rate fell to 6.31% from 6.33% the previous week. The monthly mortgage payment for a home loan of $400,000 is currently $2,480 compared to $2,680 five weeks ago when rates were above the 7% threshold.

Although mortgage rates are more than double those of a year ago, home prices continue to be higher than the previous year due to limited inventory. Looking at the housing supply by income level, buyers earning $75,000 face the most significant housing shortage compared to any other income group. In a balanced market, these buyers should be able to afford half of the homes listed for sale. However, these middle-income buyers can afford to buy only 20% of all available listings. As a result, even though there are fewer middle-income buyers in the market, there are still not enough homes for them to purchase.”