The 2024 economic outlook is a hot topic of discussion in financial circles, and it has significant implications for various sectors, including real estate. In a recent blog post by Matt Carter, he hinted that recession may be what drives rates down in 2024. While some economists anticipate a ‘soft landing’, others warn of a possible recession, which could adversely affect the financial markets and the real estate industry.

Key Points:

- Mortgage Rates and Recession: One of the key issues up for debate is mortgage rates. While there is a possibility of mortgage rates continuing to fall in 2024, economists warn that a recession could lead to a significant drop. Real estate, which faced challenges in 2023, is expected to fare better in 2024, but this will depend on various factors such as interest rates, inventory, and home prices.

- Existing Home Sales: Existing home sales, which slowed down in 2023 due to soaring interest rates, scarce inventory, and elevated home prices, are projected to rebound in 2024. NAR Chief Economist Lawrence Yun predicts a 13.5% growth in existing home sales.

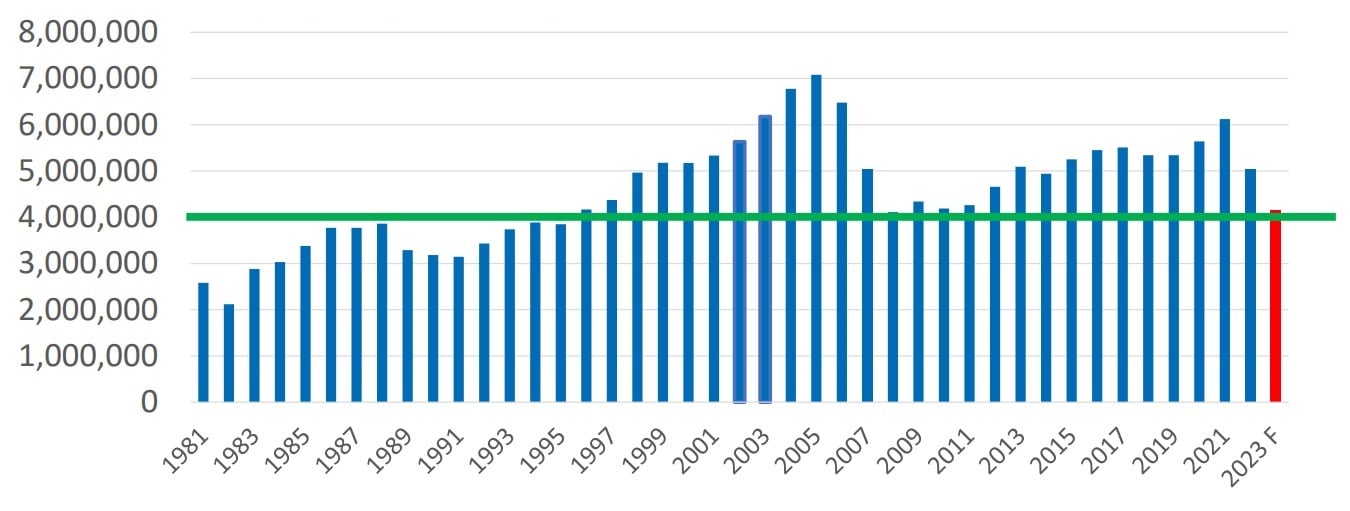

Existing home sales, 1981-2023

The National Association of Realtors estimates that 4.15 million homes changed hands in 2023, which might turn out to be the lowest sales volume in nearly 30 years, depending on final numbers for the fourth quarter. Source: NAR 2024 Economic & Real Estate Outlook.

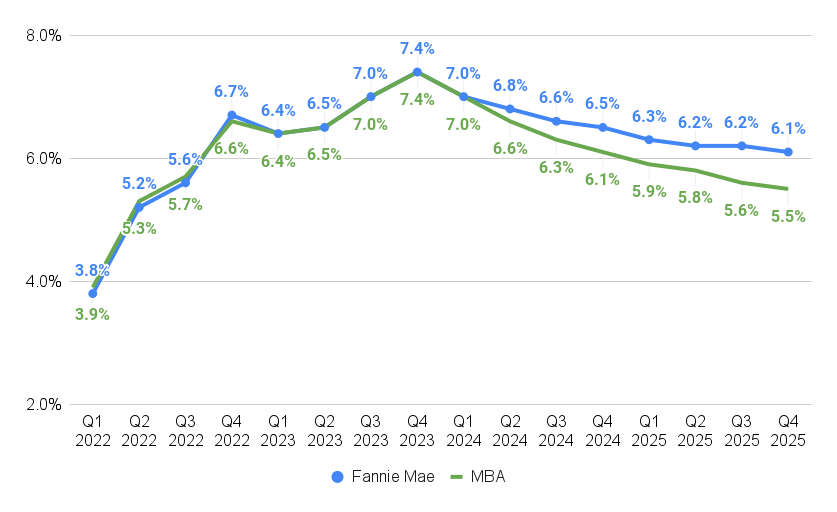

- Mild Recession Forecast & Impact on Inventory: Some economists anticipate a mild recession in 2024, which could result in even lower mortgage rates, with projections suggesting rates dropping to 6.6% and below. Lower rates may encourage hesitant homeowners to sell, thus increasing for-sale inventory. However, the scarcity of inventory and affordability challenges for first-time homebuyers could still pose obstacles.

Lower mortgage rates forecast for 2024

Source: Fannie Mae and Mortgage Bankers Association forecasts, December 2023.

- Regional Variances: Realtors emphasize the local nature of real estate markets, with expectations that markets in the Midwest, South, and East will outperform due to job increases and affordability. Notably, Washington-Arlington-Alexandria, D.C.-Virginia-Maryland-West Virginia, is identified as one of the top 10 markets for pent-up housing demand.

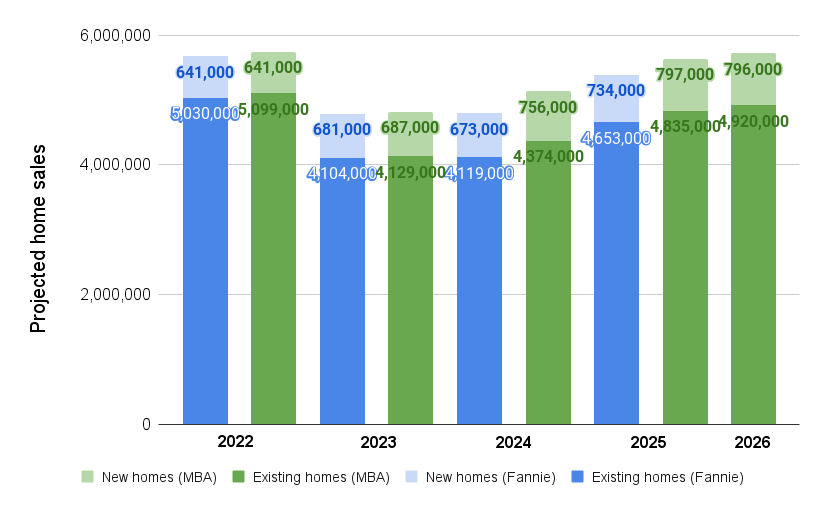

2024 home sales forecasts

Source: Fannie Mae and Mortgage Bankers Association forecasts, December 2023.

- Federal Reserve’s Role: The Federal Reserve’s plan to cut rates three times in 2024 is discussed, with debates on the timing and magnitude of these cuts. The impact of the Fed’s balance sheet runoff program on mortgage holdings is noted, presenting challenges for the real estate sector.

- Global Events and Economic Risks: The blog highlights the potential impact of global events, such as trade tensions with China and the Russia-Ukraine war, on the U.S. economy. Uncertainties and risks persist, posing challenges for economic stability.

Reacting to the Uncertainty

As we step into 2024, the real estate market finds itself at a crossroads, navigating through economic uncertainties. The interplay of mortgage rates, potential recessions, and global events will shape the landscape. The industry is in a state of flux, with projections and speculations guiding expectations. In the face of these challenges, stakeholders in the real estate sector must adopt a resilient and adaptive approach. Lawrence Yun’s insight on regional variances underscores the importance of understanding the nuanced dynamics in different markets. The identification of Washington-Arlington-Alexandria as a top market for pent-up housing demand emphasizes the localized nature of opportunities and challenges.

Navigating Together

If you’re looking to navigate through potential challenges in the current economic climate, our team is here to provide insights and support. We understand the importance of staying informed and making strategic decisions in a rapidly changing landscape. Feel free to reach out to us for a personalized discussion about how these economic factors might affect your specific market and how you can navigate through potential challenges.

At Shaheen, Ruth, Martin & Fonville Real Estate, our expertise goes beyond homes; it extends to understanding the pulse of our communities. With a deep connection to people and a commitment to navigating the intricacies of the 2024 economic outlook, we’re not just about houses; we’re about connecting individuals to lifestyles. Our passion lies in finding the perfect home in the right neighborhood, ensuring a seamless settlement into both your new home and community.